______________________________________________________________

______________________________________________________________

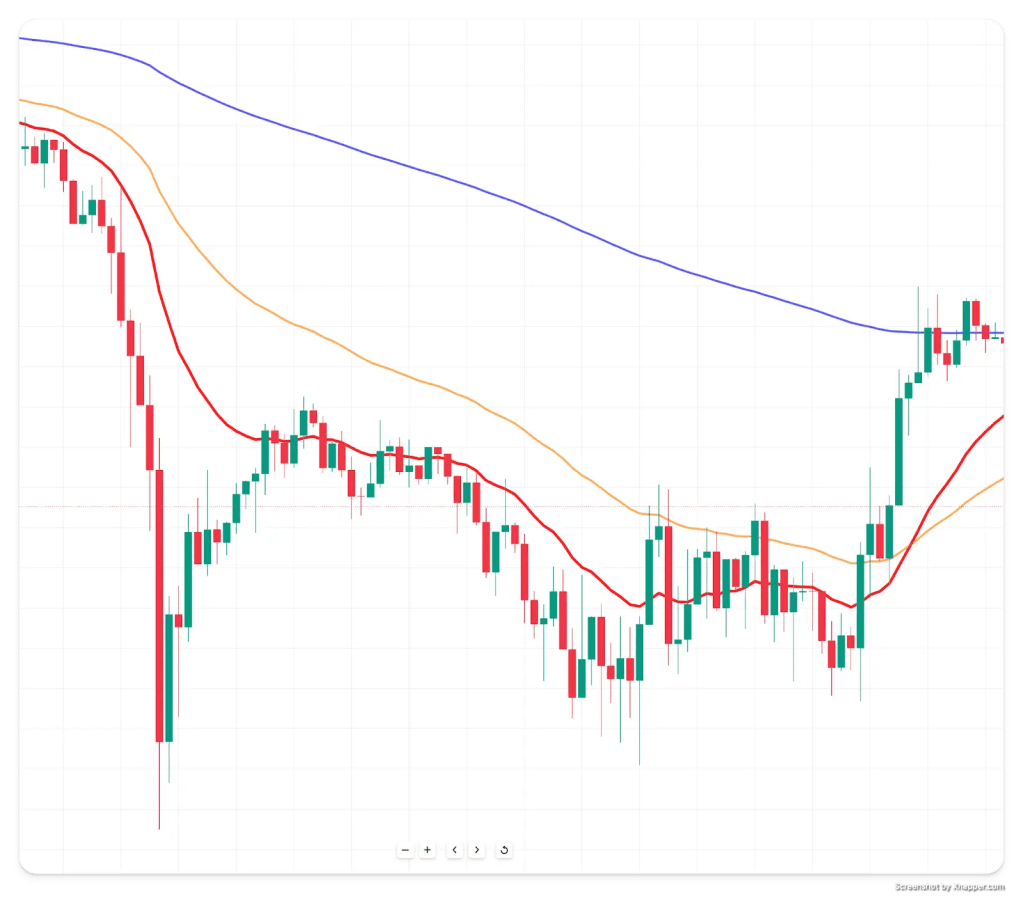

Exponential Moving Averages (EMA), a technical indicator that appears at the beginning of most traders’ journeys standing out by its simplicity and easy-to-understand approach.

The most extended strategy regarding EMA is the combination of the three longer periods:

- 20-days period.

- 50-days period.

- 200-days period.

This strategy stands out for its underlying effectiveness, carrying as a basis the idea that longer periods are more reliable to take signals from.

A 50/200 day crossover (the 50-day moving average crossing the 200-day) is famously known as the “Golden Cross” or “Death Cross” (bullish or bearish signal).

______________________________________________________________

______________________________________________________________

There are many exponential moving average (EMA) strategies, but the 50 EMA strategy is one of the most commonly used among traders in different financial markets. Let’s take a look at this 50 EMA trading strategy.

The 50 EMA strategy is a technical analysis trading strategy that uses the 50-day EMA to identify the direction of the trend and to generate buy and sell signals. The strategy is typically used by traders who are looking to capture medium-term trends in the market, and it is often combined with oscillators and momentum indicators.

______________________________________________________________